The summary

Ticker - $GREEN (ISIN SE0010985028) - Nasdaq Stockholm - Website: link

T5Y Return - 23.8% CAGR

Key ratios:

PER: 20X

EV/EBITDA: 11X

EV/EBIT: 17X

EV/FCF: 15X

ROE: 16.50%

Elevator pitch: Green Landscaping Group is a Swedish serial acquirer, leader in its market (~7% market share), that provides landscaping services in Sweden, Norway, Finland, Lithuania and Germany. ~66% of the revenue of the company comes from the public sector and contracts usually last for 3-5 years, creating customer stability and recurrence. Due to the contractual business model, revenues are expected to remain stable even during recessions, and the company is able to rapidly transfer inflation to its customers. The management is aligned with shareholders with high skin in the game (>40%). The overall market is expected to grow on a ~3-5% CAGR during the next few years, benefiting from the ecologist/nature increasing awareness that acts as tailwind. Thanks to this organic growth and by acquiring more than 30 companies, Green Landscaping Group has been able to multiply total sales by more than 6 times in 5 years (since 2017).

Introduction to Green Landscaping Group

Green Landscaping Group (the company) was founded in 2009 in Sweden as a result of the merge of 4 companies: ISS Landscaping, Jungs, Mark & Trädgårdsanläggare Sjunnesson and Qbikum. The company is a service provider of maintenance and landscaping of green areas and outdoor environments, whose mission is “improve the customer's outdoor environment by offering services that focus on high customer value, long-term sustainability and quality”. Those services are divided in three categories: (1) Landscaping and construction; (2) Ground maintenance; and (3) Road maintenance and snow & ice removal.

One of the keys of the company rapid growth (38.5% CAGR in sales from 2016 to 2022) has been its focus on acquiring businesses. With a vision of “offering a home for entrepreneurs”, Green Landscaping Group has acquired more than 40 companies since its launch, including companies from Sweden, Norway (2020), Finland (2021), Lithuania (2022) and Germany (2023). $GREEN follows a decentralized management & operational model, since it considers that independent companies with a local leadership that knows their market and the company’s conditions, have the best prerequisites for success - all acquired companies retain their freedom to run the business under their own brand. This creates two roles:

Subsidiaries (99%), have full commercial responsibility and great freedom to run their business independently of each other and the Group. As a rule, they have strong local ties and run the business under their own brand.

Group functions (1%), provides the support and control functions, including the Lean and M&A teams. It also provides access to capital. Regional managers facilitate and encourage contact between subsidiaries. The organization is very streamlined, since individual companies retain business responsibility themselves, which includes a significant portion of the financial control and corporate governance, regulatory compliance, HR and communication.

Customers are primarily county councils, municipalities, property managers, property companies and others who own or manage green areas associated with urban development, and the market is characterized by long contracts and customer relations stretching over many years is common (public customers represent ~66%, private ~33%).

Relevant events

Phase 1: objective: Increase sales and become leading player (2009-2015).

2009: Landscape Services Group is established by FSN Capital III, through the merger of Jungs, ISS Landscaping AB, Mark & Tradgardsanlaggare Sjunesson and Qbikum Mark och Park AB.

2010: The company brand is changed to Green Landscaping.

Phase 2: objective: Operational efficiency (2016-2017).

2015: Johan Nordstrom joins as CEO.

Phase 3: objective: Focus on acquisitions and international expansion (2018-now).

2018: the company is listed on Nasdaq First North.

2019: the company is listed on Nasdaq Stockholm.

2020: expansion to Norway via Gast Entreprenor AS and PARK i Syd AB.

2021: expansion to Finland via Viher-Pirkka.

2022: expansion to Lithuania via UAB Stebule.

2023: expansion to Germany via Schmitt & Scalzo.

The business

Green Landscaping Group offers three main types of services, where prices can be fixed, indexed to inflation (‘Entrepenadindex’ as reference) or mixed:

Landscaping and construction (30% of sales, fixed per project): design, planning and implementation of outdoor environments. Payment is typically upon completion of the work or by milestone, and the contract value of these project is typically in the range of SEK 1–20 million (average length between 3-6 months). Examples: Marketplaces, residential outdoor environments, parks, churchyards, playgrounds and recreation sites.

Ground maintenance (50% of sales, indexed): cleaning, lawn mowing, pruning, planting, harvesting and road maintenance. Usually, 3 to 5-year contracts that can be extended for extra 2-4 years, with a revenue in the range of SEK 5-20M per annum. It benefits from high up selling rate from landscaping and construction projects.

Road maintenance and snow & ice removal (20% of sales, indexed): service offered on roads, streets, park areas, marketplaces and the grounds surrounding properties. Customers pay a fixed fee for having it available, and pay a variable price per service.

Due to the nature of the business, the sales of the company are highly affected by weather and outdoor temperature. Taking margins and sales into account, we can observe that Q1 is the weakest quarter and Q4 the strongest:

EBITA margins per quarter (2019-2022):

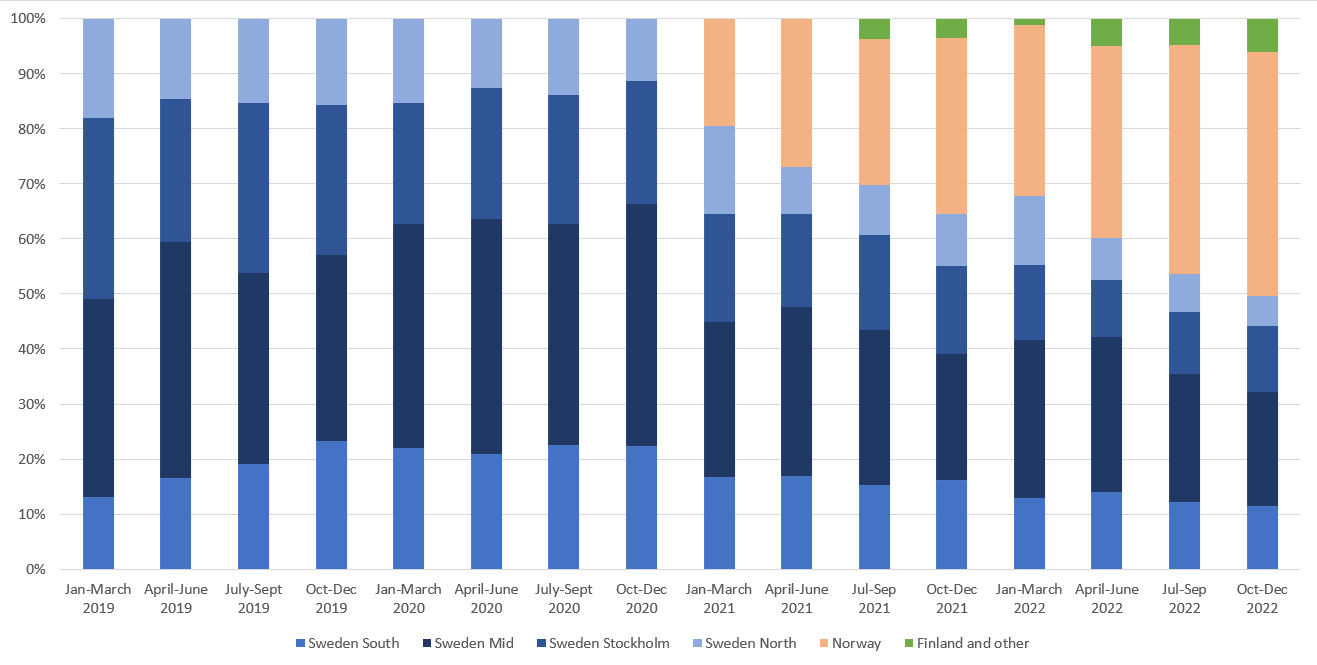

As mentioned before, $GREEN operates in 5 countries but the sales depend mainly on Sweden (~56% of total sales, divided in 4 regions*) and Norway (~39%), which are also the biggest addressable markets.

Sales split, per region (2019-2022):

*For reference: Sweden region clustering was changed in Q4’20, where old region “West” changed its name to “Middle”, “East” was renamed as “Stockholm” and “Middle” was incorporated to “North” region. In this analysis, we will use the latest naming categories only.

Taking FY’2022 figures as example, we can observe the disparity between overall EBITA margins, Sweden Mid and Stockholm regions being the lowest:

In terms of growth, the company expects the landscaping business to grow by approximately 3-6% CAGR over the next few years, positively affected by macro trends such as urbanization, population growth and focus on sustainability - for example, the “3-30-300 rule” by Cecil Konijnendijk, which claims that 3 trees must be visible from all homes, 30 percent tree canopy coverage must be present in all residential areas, and that no one must have more than 300 meters to the nearest park or green area. In fact, the company has achieved a 5.3% average organic growth YoY, supporting that assumption (with Covid-19 year included).

Organic growth per quarter:

On the other hand, total sales have increased at an impressive CAGR of 24.9% in the same period. This difference can be explained by one of the main priorities of the company: acquiring high quality business to grow inorganically.

M&A

“Our acquisition strategy, simply put, is to offer a home for entrepreneurs. Gathering a handful of companies in the same geographic area enables their entrepreneurs to exchange knowledge and to develop. And when they interact, it spurs innovation and opens up more sales opportunities. But above all, it gives them something they had previously lacked, namely, colleagues and a wider network. We frequently hear that this is what they value the most. They get to interact on their own terms, retaining the freedom to run the business as they see fit.” - Jakob Körner, Head of M&A

The outdoor environments market is characterized by fragmentation, with over 18,000 companies operating within it. These companies tend to have deep-rooted connections within their local communities and have developed established practices and structures over a considerable period, which contributes to create a strong and independent identity. Green Landscaping follows a decentralized operational model to benefit from this tailored expertise, where the acquired companies are entrusted with full commercial responsibility and enjoy considerable autonomy to operate under their own brand, allowing them the freedom to run their respective businesses. On a quarterly basis, the company sends a ranking list with EBITDA contributions in both absolute numbers and expressed as profit margin, encouraging healthy competition.

The company targets well-functioning, stable and profitable companies, where the expected return on capital is around 20 percent. Historically, the paid price has randed from 4-6x EBITA, paying in a 80% cash - 20% shares model.

Green Landscaping acquisition process phases:

Source: Green Landscaping Group - IPO Nasdaq Stockholm prospect (2018)

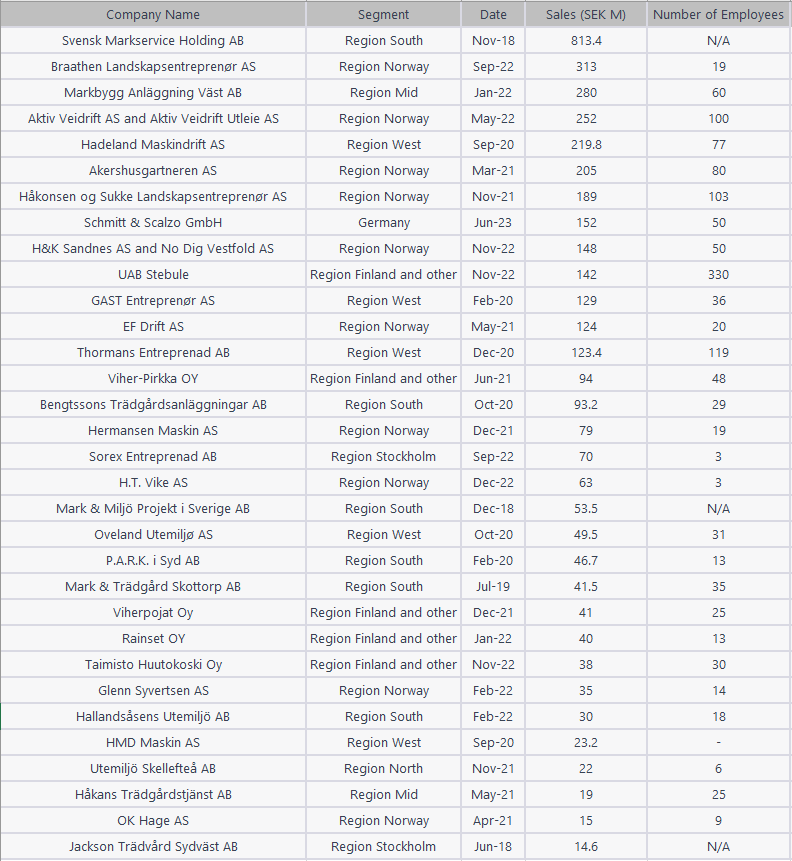

List of completed acquisitions, ordered by expected sales:

Financial targets

The company management has also established 4 main financial targets that they track on a quarterly basis:

Sales shall, on average, grow by 10 percent per year (organically and via acquisitions). The company has exceeded expectations and has reached the goal consistently (with the exception of 2020 due to Covid).

EBITA margin shall amount to 8 percent or more. In 2022 the company has finally reached this milestone. This has been achieved with the benefits of scale and the international expansion, where the company tends to have a higher margins.

Net debt in relation to EBITDA shall over the long term, not exceed 2.5 times. We have observed a positive trend in leverage reduction even with the demanding acquisition strategy.

Approximately 40% of profit for the year shall be distributed as dividends to shareholders. No dividends have been distributed due to the amount of acquisition opportunities in the market, prioritizing growth.

Benefits

The main benefits of the business model of the company are:

Stricter requirements for larger contracts and industry regulations: public customers and major contracts have specific requirements when assigning a contract. The company wide experience and track record (previous contracts in a specific region/customer) can provide a competitive advantage.

Economies of scale: when joining the company, acquired companies are integrated in a wider network of knowledge, expertise and connections. For example, the company invests many resources in leadership programs to develop local teams, creating growth opportunities and incentives for the company local employees (which are vital to run the decentralized model). Additionally, $GREEN has the possibility to centrally negotiate inventory pricing, increasing the business margin.

Broader service offering and cross-sales: thanks to the large amount of companies of the group, $GREEN is able to offer a wide service portfolio with a large geographical coverage and with many opportunities to cross-sell (for example, many landscaping and construction projects are extended to ground maintenance contracts. Additionally, the decentralized model allows the company benefit from local entry barriers such as language skills, quality standards, references from previous projects, etc.

Risks

Some of the main risks of the company are:

M&A execution and the performance of acquired units: the company is incorporating a lot of different companies that are managed independently, shifting the business performance to the respective local management. Acquisition due diligence process is vital to ensure a proper cultural fit, especially in a multi-country business model (the company has expanded to Norway, Finland, Lithuania and Germany in 4 years, a demanding timeline).

The aggressive acquisition model requires capital: a rapid increase of issued shares (following the 80% cash - 20% shares strategy) and leverage can harm the earnings per share and the financial position of the company.

Increasing scale: following the company growth, $GREEN will need to acquire larger and more market-established companies, increasing the acquisition price and reducing the ROI & growth rate. Additionally, there is a higher likelihood of attracting increased competition from other businesses and financial entities, which might reduce acquisition opportunities and increase their prices.

Public sector budget: Green Landscaping group largely depends on public sector customers (~66%) and hence their budget on landscaping services. As it can be seen below, the company has benefited from increasing expenditure on landscaping services, but the trend could change in the future, reducing the company growth.

Development of municipal expenses for park management compared with GDP and construction:

Source: Green Landscaping Group - IPO Nasdaq Stockholm prospect (2018)

The management

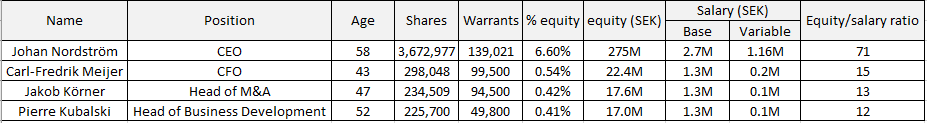

CEO: Johan Nordström (58 years, 6.6% of equity), more than 20 years of experience from leading positions at several companies with international operations. Has been the CEO of Green Landscaping Group since 2015 and before that, CEO and Chairman of the Board at Car-O-Liner Group AB.

CFO: Carl-Fredrik Meijer (43 years, 0.54% of equity), More than 15 years of experience from positions in accounting & finance, strategy and business development in both Sweden and other countries. For example, he worked at PwC in London and Coor Service Management AB (publ).

Head of M&A: Jakob Körner (47 years, 0.42% of equity), Previously worked at Svevia as Manager and Business Controller.

Head of Business Development: Pierre Kubalski (52 years, 0.41% of equity), More than 20 years of experience in manufacturing industry as site manager or CEO. Has worked at both Danaher and Colfax.

Remuneration to the Board of Directors: SEK 350K for chairman and SEK 250K for board members.

Shareholder structure

Executive and board directors hold approximately ~41% of the total company shares, and top 10 largest shareholders account for ~60%. Some of the most relevant non-executive shareholders are:

Salén family (16.1%): mainly represented by Staffan Salén, who is a board member since 2018. He acts as a board director/chairman in different swedish companies, and has been nominated as the president of the Stockholm Chamber of commerce.

Byggmästare Anders J Ahlström Invest AB (15.8%): a long-term, market niche investment company. It is also represented in the board by Tomas Bergstrom, board member since 2020.

AFA Försäkring (6.4%): Swedish insurance company.

Per Sjöstrand via company (1.7%): chairman of the board of directors of the company. He has also been the founder and CEO of Instalco in 2014-2021 - one of the reasons why we can find so many similarities between the decentralized roll-up model of the two companies. He has reduced his equity over time (1.7M shares (4.7%) in 2019 vs 0.9M (1.7%) in 2023). Considering he is 65yo, we assume he is reducing exposition for retirement.

Competitors

According to the company estimations, the total size of the landscaping market in 2023 is estimated at around SEK 325 billion, with a TAM for the company of approximately SEK 105 billion. This is divided by:

Sweden (SEK 40B), where the company has estimated market share of ~7%. Other large players are HTE Produktion and BITE.

Norway (SEK 44B), where the company has estimated market share of ~4.4%. Other large players are Steen & Lund, Braathen Landskapsentreprenor AS and Vaktmester Kompaniet.

Finland (SEK 16B) and Lithuania (SEK 6B), where the company has estimated market share of ~1%. Other large players are Jaamestarit and Tieluiska.

The company groups competitors in 5 main types of companies, depending on their focus area:

Source: Green Landscaping Group - IPO Nasdaq Stockholm prospect (2018)

Full-service companies: offer pure-play gardening and landscaping services.

Construction companies: focus on infrastructure and construction projects with limited presence in gardening and landscaping.

Cooperatives: large-scale players with capacity to utilize available equipment depots.

Property management companies: focused into more opportunistic gardening activities.

Specialist companies: niche services.

We haven’t been able to find any publicly-traded company that would classify as direct comparable for Green Landscaping group, and the sector is highly opaque. In the table below we are then contrasting the company main financial and valuation metrics with other serial acquirers of the Swedish stock market, even though their business area and scope differs significantly:

Instalco: Founded in 2013, Instalco AB (publ) provides installation services in the heating and plumbing, electrical, ventilation, cooling, and industrial areas in Sweden and rest of Nordic.

Fasadgruppen: Founded in 1963, Fasadgruppen Group AB (publ) operates as a service provider of facades in Sweden, Denmark, Norway, and Finland.

Sdiptech: Incorporated in 2004, Fasadgruppen Group AB (publ) operates as a service provider of facades in Sweden, Denmark, Norway, and Finland.

Comparable financial metrics, 2019-2022:

Main valuation ratios vs comparables:

Valuation scenarios

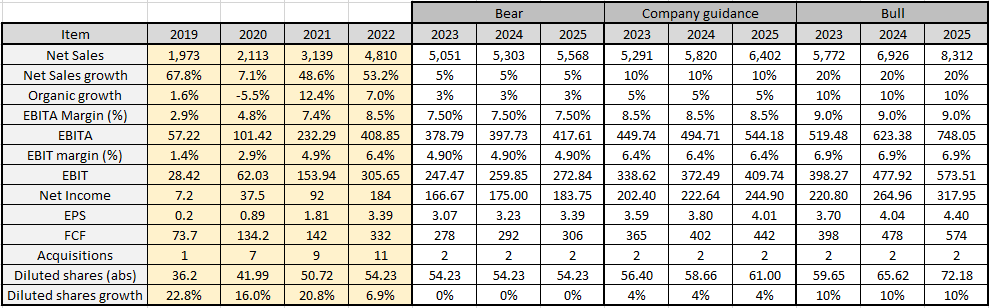

We will consider three scenarios:

Bear scenario: total growth CAGR of 5% (3% via organic and 2% via acquisitions). EBITA and EBIT margins of 2021 (7.5% and 4.9% respectively). The company is able to acquire those companies using the FCF, so no new shares are issued.

Company guidance scenario: total growth CAGR of 10%, EBITA and EBIT margins from company target and 2022 (8.5% and 6.4%), average dilution of 4% per year.

Bull scenario: total growth CAGR of 20%, EBITDA and EBIT margins above expectations (9.0% and 6.9%), yearly dilution of 10%.

Bear, Company guidance and Bull estimations (2023 - 2025):

Current valuation ratios (at EV SEK 5.8B and Price SEK 75):

Valuation & conclusion

After analyzing the company, we can clearly see the value proposal: Green Landscaping group aims to consolidate a market that is very fragmented, characterized by long-term contracts that can generate predictable and recurring revenue streams, benefiting from the huge tailwinds of the “go-green” movement from western societies, expecting an annual sector CAGR of 3-5%. The company management has both experience and skin in the game, and the current market share is still relatively small vs the TAM.

We are aware of our extremely conservative bias even when defining the bull valuation scenario (Q1 results also hint towards underestimation). Nevertheless, we prefer to be safe in the current uncertain market, hence we will take the company guidance scenario as our base case. Taking that into account, the size of the opportunity and the positive characteristics of the paragraph above, we believe the following valuation ranges in 3 years (2025) would be close to the fair value:

EV/EBITA between 14 and 16X.

EV/EBIT between 18X and 20X.

EV FCF between 17X and 22X.

PER between 20X and 25X.

With those very conservative assumptions, this would mean a valuation range between SEK 95 and SEK 100, or a 8-10% CAGR at the current price. This is neither taking into account the newly-created growth opportunities from the expansion to Germany, or future dividends (which is one of the strategic targets of the company). We are aware, thought, that nothing can grow indefinitely, and the good results of the company might attract new competitors. Together with the company scale, both can lead to an increase on the price paid for acquisitions and, hence, result in a reduction of the growth rate, affecting the valuation of the company.

Lastly, Swedish central bank has not raised interest rates as fast as other regions, leading to a depreciation of the swedish krona, which can be both a risk due to the depreciation of our investment but also an opportunity in the current multi-currency business model (especially EUR). We are also confident on the capacity of $GREEN to convey increasing inflation costs via the indexed contract mechanisms (Entrepenadindex).

SEK vs EUR exchange rate

Key aspects to monitor: prices paid per acquisition, organic growth and public landscaping budget.

Other links

Green Landscaping Income Statement, Balance Sheet and Cash Flow Statement: Link.

Serial acquirers equity research, by Redeye: Link

Green Landscaping Group analyst coverage: Link

Disclaimer

The content and materials featured or linked to on Moku Capital are for your information and education only and are not attended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such. Moku Capital does not assume responsibility of the usage of this information. Always do your own research and seek independent financial advice when required. Any arrangement made between you and any third party named or linked to from the site is at your sole risk and responsibility. Moku Capital and its associated writers assume no liability for your actions. The value of investments and any income derived from them can fall as well as rise and you may not get back the original amount you invested.